Why Choose WorldFirst for Paying Your Business Partners?

Why Choose WorldFirst for Paying Your Business Partners?

Efficient international payment processing is critical for firms with worldwide operations. WorldFirst provides a dependable and cost-effective payment option for your business partners, enabling seamless cross-border transactions. With reasonable exchange rates, no hidden costs, and a variety of payment alternatives, WorldFirst simplifies and secures overseas transfers. It is an excellent solution for firms wishing to easily handle their foreign financial demands since it offers numerous currency accounts and flexible payment tools.

What Makes WorldFirst Ideal for International Payments?

Competitive Exchange Rates and Transparent Fees

WorldFirst stands apart from the competition because of its rock-bottom exchange rates, which provide significant savings compared to other banks. By participating in the program, businesses can be certain that they will get transparent pricing with no surprises. When compared to other options, their currency conversion charges of 0.60% make international transactions more cheap. The clear pricing structure allows businesses to accurately predict costs and ensures that your company keeps more of its hard-earned money while transacting on a global scale. When handling cash conversion, WorldFirst ensures minimal impact on your bottom line.

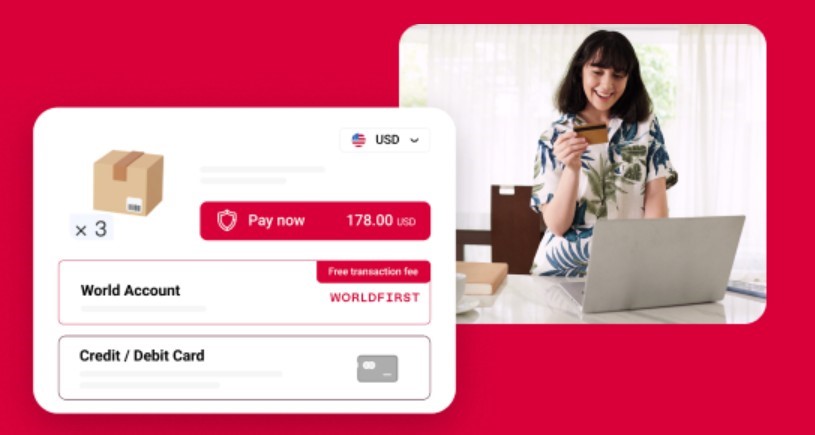

Multiple Currency Accounts and Payment Options

The option to create up to 22 currency accounts is one of the main advantages of utilizing WorldFirst, which helps firms handle transactions in different currencies more easily. WorldFirst provides a smooth payment experience regardless of whether your partners or suppliers are located in the US, Europe, or other international markets. Businesses may better manage their cash conversion demands by having the option to store several currencies and make payments in local currencies, which guarantees easier operations and greater control over foreign transactions.

No Hidden Fees or Monthly Charges

WorldFirst takes pride in providing a price structure that avoids surprises. There are no hidden fees or recurring costs, so companies can plan their financial transactions with confidence. Whether you are making regular payments or managing infrequent transfers, you can depend on clear pricing and avoid surprise charges, as is common with conventional banking institutions.

How Can WorldFirst Streamline Your Business Payments?

Instant Payments and Same-Day Transfers

WorldFirst guarantees speedy and effective payment processing. You can guarantee that your business partners and suppliers get their payments on time by allowing for same-day transfers. Instant payments, particularly to other WorldFirst clients, make transactions even smoother, ensuring that your company activities remain uninterrupted.

Batch Payments for Multiple Invoices

Managing several invoices may be a time-consuming process; however, WorldFirst’s ability to process payments in batches makes this process much simpler. Within a single transaction, you are able to make payments for as many as two hundred invoices. By reducing the amount of administrative work that has to be done and ensuring that your business partners are paid on time, this feature assists in the improvement of relationships and the maintenance of trust with your contractors and suppliers.

Scheduling Payments for Future Dates

WorldFirst gives companies the ability to arrange payments for future dates, which further increases the efficiency of their operations. Businesses that are responsible for managing several suppliers or that are preparing ahead for regular payments may find this option to be very helpful. You will be able to guarantee that payments are made on time and prevent missed deadlines if you automate this process. Additionally, you will release precious time that you can use to concentrate on other elements of your organization.

How Does WorldFirst Manage Currency Conversion Risks?

Locking in Rates with Forward Contracts

WorldFirst allows companies to lock in currency rates for up to two years via advance contracts. This solution is especially useful for organizations that need to control currency swings. Setting a rate in advance allows you to prevent unexpected charges and plan your budgets more accurately, guaranteeing financial stability and improved cash flow management. This is especially critical for firms that need to successfully manage cash conversion over time.

Monitoring Exchange Rates and Targeting Your Rate

WorldFirst allows you to establish target rates for currency conversions. The software will monitor the currency rate for you and make the payment immediately whenever it reaches your objective. This function guarantees that your firm takes advantage of advantageous exchange rates, allowing you to properly control your foreign currency expenditures and improve your payment strategy. Targeting particular rates for the best bargains simplifies cash conversion management.

Flexible Currency Conversion in Your World Account

Managing currency conversion in your WorldFirst account is simple. The tool enables firms to exchange money between several currency accounts straight via the internet site. This flexibility makes it simpler to pay suppliers, settle debts, and adapt to fluctuating currency rates, giving you more control over your overseas finances. It enables your company to conduct cash conversion easily and without any needless complications.

How Does WorldFirst Ensure the Security of Your Payments?

Partnering with Tier-1 Banks for Secure Transactions

WorldFirst collaborates with reputable, tier-1 institutions like CitiBank, JP Morgan, and Barclays to guarantee the security of every transaction. Given that these institutions adhere to the strictest guidelines for financial security, these collaborations ensure that your money is in capable hands. Businesses may now interact internationally with confidence, knowing that their money is safeguarded by strong security protocols.

Transparent Payments with Real-Time Tracking

WorldFirst monitors payments in real-time, which enables the company to provide complete transparency. Through the use of this function, companies are able to monitor the progress of their payments at each and every stage of the process. Because you will have quick alerts and total insight into your transactions, you will be able to keep informed and make certain that your payments are completed as intended, which will provide you with more control over your foreign payments.

Segregated Accounts for Safeguarding Your Money

Your funds are safe with WorldFirst since they are kept in individual accounts for each customer. Keeping your funds distinct from those used to run the business adds an additional layer of security. This platform offers a dependable solution for enterprises to handle their foreign payments, ensuring the continued safety of your funds in line with regulatory requirements.

Conclusion

WorldFirst provides organizations with a comprehensive, secure, and cost-effective solution for handling international payments. It streamlines worldwide transactions by providing competitive exchange rates, clear fees, and features like forward contracts, batch payments, and real-time monitoring. WorldFirst assures the efficiency and security of your payments by working with tier-1 banks and offering multiple currency conversion alternatives. Choose WorldFirst to simplify your company payments and lower risks while saving time and money.