What Are the Benefits of Home Insurance?

Homeowner’s insurance is often required by mortgage lenders, but if it isn’t required, is it necessary to have? Though costs for insurance can be high in some locations and it’s an extra expense to pay every month, it is incredibly beneficial. Homeowners will appreciate being able to have someone to turn to for help if anything happens. Some of the top benefits of home insurance include the following.

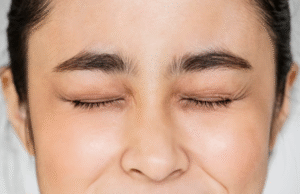

Peace of Mind

The main reason for insuring your home is because it helps to provide peace of mind. Homeowners who are insured know that if anything happens to their home, the insurance covers the damages and the home can be restored. There are a variety of situations where homeowners insurance can help, from natural disasters to break-ins, so that homeowners can fund restoration or rebuilding without having to pay everything out of pocket.

Protect Against Natural Disasters

Natural disasters can occur anywhere, though some are more likely to occur in certain areas compared to others. When a natural disaster does occur, it can cause severe damage to homes or they can be completely destroyed. A fire, earthquake, hurricane, or other natural disaster that occurs can mean needed to do extensive restoration for the home to be livable again or rebuilt completely. With insurance, funds are available to cover the damage done so restoration can begin immediately.

Protection Against Break-Ins

When someone breaks into a home, there is the potential for damage to the home as well as missing belongings. While the hope is that the belongings can be recovered, this isn’t always possible. The home insurance policy, though, will cover any repairs that are needed for the home as well as help to cover the cost of replacing anything that was stolen. If the door was kicked in and items were taken from the home, insurance will cover everything to make the homeowner whole again.

Liability Coverage

Something many homeowners might not realize about their policy is that it includes liability coverage. If a homeowner is accused of causing an injury to a guest on their property, whether the injury was intentional or caused by negligence, they can be sued to cover the cost of medical bills and related expenses for the injured person. If this happens, the insurance company will help provide a lawyer and cover the settlement if the courts determine the homeowner is liable for the situation.

Living Expenses Coverage

If anything happens and the home is unlivable temporarily while repairs are made, the homeowner may need to stay in a hotel or other accommodations. The home insurance policy will typically provide a set amount per day to cover hotel costs, food, and other expenses while the person or family can’t be in their home. This coverage can last as long as needed until the repairs are done and the person can move back into their home. The specific amount given per day as well as the length of time this lasts will depend on the policy.

If you don’t have homeowner insurance or you’re not sure the coverage covers everything necessary, it’s a good idea to look into the policies available today. Take the time to shop around to find the best deals on home insurance to save money while making sure the home is protected from potential damage.